Buying and Selling Homes in Flood Zones: What Every Agent Should Know

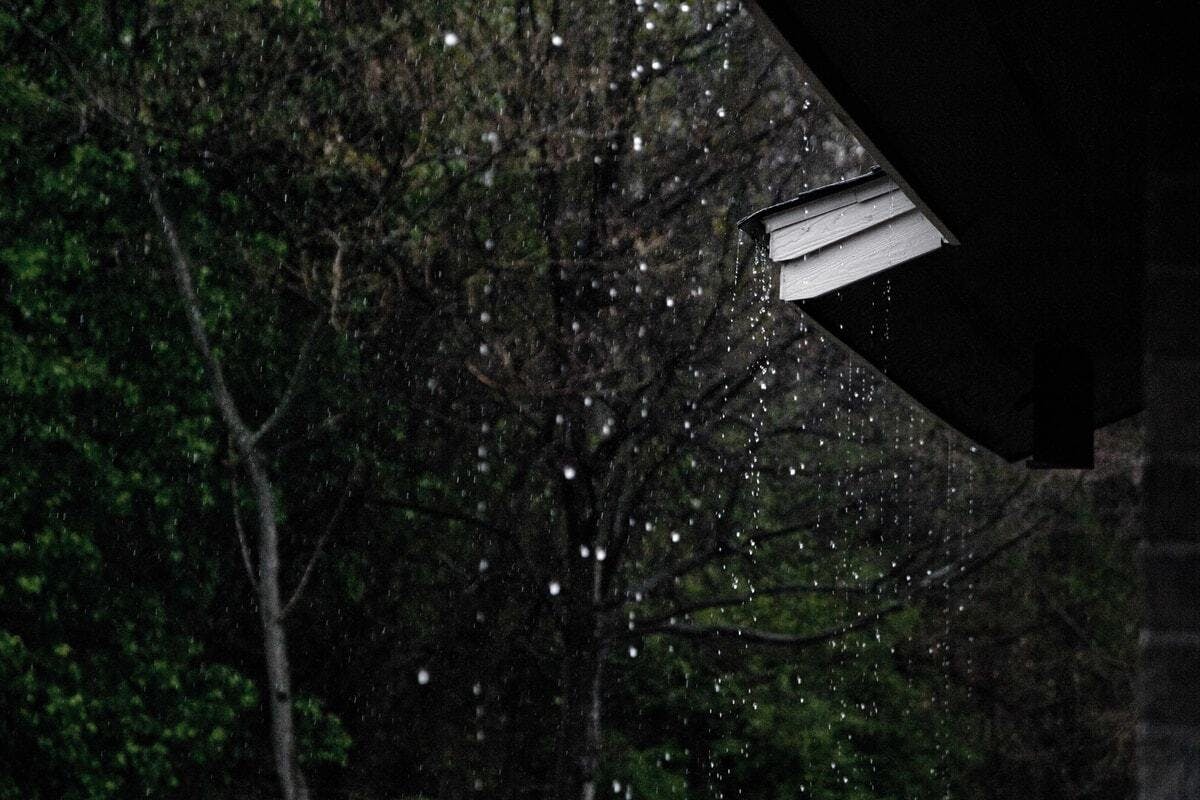

Hardly a day goes by that we don’t see a news report about the weather and its devastating effects on property. Flooding, whether caused by a single event or rising sea levels, looms larger than ever as a risk factor for those considering buying or selling property today.

How big of a concern should this be for you as a real estate agent?

The answer to that will vary, depending on your location. But as the Federal Emergency Management Agency says, “Anywhere it can rain, it can flood.”

What Is a Flood Zone?

A flood zone is a geographic area defined by the Federal Emergency Management Agency (FEMA) according to its flood risk level.

Here are the three risk zones FEMA uses, along with their respective flood zone codes:

High-risk zone: This designation is reserved for Special Flood Hazard Areas (SFHA). The zone codes for this designation are A or V, the latter being an indicator that the property is in a coastal area.

Moderate-risk zone: Here, flooding is possible but less likely to occur. The zone codes for this designation are B or X (shaded).

Minimal-risk zone: These geographic areas have little risk of flooding, but again, it can happen. Zone codes for this designation are C or X (unshaded)

You can use FEMA’s Flood Map Service CenterBuying A House In A Flood Zone Learn to see the flood zone designation for a particular piece of land your client is trying to buy or sell.

Plain Talk about Floodplains

To help your clients make sense of FEMA’s flood zone information, turn it into something meaningful that they can use to make decisions.

For example, properties in the high-risk zones have a 1% chance annually of flooding. While that may sound pretty low, it actually translates into a 26% chance of flooding at some point during a 30-year mortgage timeframe! For this reason, owners of properties in High-risk zones are required to get flood insurance.

And if your clients think that only properties in FEMA’s high-risk zone should be of concern, inform them that the National Flood Insurance Program (NFIP) reports that properties outside the high-risk zone can represent up to 40% of their flood claims in a given year.

A More Timely Flood Risk Assessment Tool

One of the biggest drawbacks to FEMA’s data is that it can be severely outdated for the areas you and your clients are interested in.

For a more user-friendly and up-to-date resource, you might consider accessing Flood Factor®Floodfactor.com, a free online tool that has grown in popularity and has recently been integrated on real estate platforms Redfin, Realtor.com®, and Estately.

As with FEMA’s website, you can use Flood Factor® to get an estimate of the flood risk of a particular property by plugging in the property address.

Flood Insurance

According to FEMA, just one inch of floodwater can cause up to $25,000 in damage, most of which would NOT be covered by a typical homeowner’s insurance policy.

Those in need of flood protection can purchase it separately from the National Flood Insurance Program (NFIP) through their insurance company or insurance agent. If they need help finding a provider, they can go to Flood Insurance ProviderFloodSmart.gov/flood-insurance-providerFloodSmart.gov or call the NFIP at 877-336-2627.

If your client desires more coverage than is provided through the NFIP, they might be able to find a private insurer to cover that excess amount.

Also, you might save your client money by seeing if the previous owner has a policy through the NFIP. Some agents have reported success in getting the NFIP to let the buyer take over the existing policy when the property conveys, saving their client thousands of dollars in the process!

Plan Ahead

If flood insurance IS in their plans, advise your clients that there is typically a 30-day waiting period for an NFIP policy to go into effect, unless…

The coverage is mandated

It is purchased as required by a federally backed lender, or

It is related to a community flood map change

As of 2022, the average cost of flood insurance was $958 a year. The actual amount will vary greatly, depending on the specific location of the property.

Selling a Home in a Flood Zone

If you represent a seller in a flood zone — and ALL property is in some kind of flood zone — you’ll want to make sure that you and your client are aware of the latest FEMA flood zone status for the property being sold. This can change, so don’t make any assumptions.

Disclose What You Know

Additionally, you should discuss any applicable disclosure requirements that the seller has. Disclosure requirements are mandated on a state level and will vary from very strict to nonexistent!

Regardless of what the state mandates, it will serve you well to encourage your client to disclose freely and fully the condition of the property, including its flood history. It’s the right thing to do, and it could keep you out of court.

Flood Mitigation

Hopefully, your seller-client has taken efforts to mitigate their property’s flood risk over the years for their own peace of mind. But even if they haven’t, they might want to consider doing so now in preparation for selling.

Savvy buyers (and their agents) will ask what flood mitigation measures are in place, and they will factor your response into their offers.

Some flood mitigation efforts are simple and relatively inexpensive. Others are significantly more involved and expensive. Here are some examples, big and small, of what can be done in the name of flood mitigation:

Raising the home out of the flood plain (in coastal areas)

Anchoring or elevating HVAC units or propane fuel tanks

Installing backflow valves or sump pumps

Grading the landscape away from the home

Sealing the garage door and cracks in the foundation

Adding flood walls and flood vents

In the end, your seller-client should look at flood mitigation efforts much in the same way most sellers view other home-improvement projects leading up to the sale. You will want to help them with the math, showing them how money spent upfront on flood mitigation measures can return to them in the form of a higher sale price.

Buying a Home in a Flood Zone

When representing a buyer of property located in a flood zone, your professional expertise takes on greater importance. You will know things your clients don’t know, AND you will know when to call in specialists as needed.

Flood Forensics

A property with a flood history will leave clues. Those you don’t see yourself might be revealed when the home inspection (that you INSIST your buyer have done) is completed. Make sure to ask if the inspector has experience with flooding and uses a moisture meter during their inspection.

Then, if you feel that additional investigation is warranted, consider asking others in the neighborhood, particularly on the same street, about the area’s flood history. Local news online archives could also be helpful.

Perhaps your greatest investigative resource in this regard will be the local floodplain manager. They know their way around FEMA flood maps and have additional resources, including historical reports and information specific to your client’s location. Best of all, their services are free!

If the property being considered is in an SFHA, the local floodplain manager might be able to provide your client with an existing elevation certificate (EC), which will likely be required to purchase flood insurance.

Reducing the Risk

Remember to ask the seller what mitigation measures are in place. Some mitigation efforts might not be visible to the eye but are significant nonetheless. And a property owner who has undertaken the effort and expense of flood mitigation has likely also maintained the property responsibly in all other aspects as well.

Consider the Additional Costs

Buying a home in a flood zone can entail additional costs not experienced in other areas.

Make sure to factor in the cost of Flood Insurance when helping your buyer-client put together an offer. Remind your buyer that if they are financing the purchase with a government-backed loan, flood insurance will be required if the property is in an SFHA.

And if some immediate flood mitigation efforts are in order, consider those as well when crafting your client’s offer to purchase.

Getting Your Feet Wet with Flood Zone Real Estate

Are there additional complications to overseeing real estate transactions involving property in flood zones? Sure. But there are also reasons for agents like you to jump in with both feet.

It’s an opportunity to establish yourself as a specialist in flood zone properties — many of which are high-priced coastal properties. And with the advent of climate change and rising sea levels, the demand for real estate professionals with expertise in SFHA properties is only expected to grow.

And don’t limit your thinking to the coasts; every state in the country needs real estate professionals with flood zone expertise. Whether caused by coastal surges, mountain snowmelt, ice jams, river flooding, failing dams, overwhelmed drainage systems, or something else altogether, flooding is the most common natural disaster in the United States. And it’s a year-round risk — one for which you can become perfectly suited to help your clients manage.

Want to get your Real Estate License? Begin your Pre-Licensing Course today!

What Legal Contracts Are Used When Buying Michigan Real Estate?

To buy a home in Michigan, there are a number of legal contracts, involved in the purchase and sale of property. Here's a breakdown of a few of the basic contracts.

Top Necessary Features for Homes in Hurricane Risk Areas

Homeowners, buyers, and real estate agents need to know about hurricane risks and how to ensure the home is protected from wind and water damage.

What Agents Need to Know About Helping Clients Buy Homes in Wildfire Danger Zones

There is a growing concern for homes in wildfire danger zones. Here is everything a real estate agent should know to help their clients in wildfire dangers zones.

Want to know more about being a real estate agent?

Ready to get going? Hit the ground running with everything you need to know to advance your career in real estate.